Trade uncertainty and nagging inflation made Federal Reserve (Fed) Chair Jerome Powell walk a tightrope at the latest press conference. The Chairman of the Fed’s monetary policy-setting committee stressed the uncertainty about economic forecasting, tariff impacts, and the growth outlook. As investors search for clarity under the new administration, they should look for opportunities despite the trials. The tailwinds of deregulation and tax relief could partially offset decreases in immigration and retaliatory tariffs. The U.S. — currently ranked 18th in international tax competitiveness — has an opportunity to improve its standing and thereby spur economic activity.

Out of Balance

The Federal Open Market Committee (FOMC) struck the phrase about risk to growth and inflation as roughly “in balance” in yesterday’s statement. As growth prospects falter and inflation remains sticky, we should expect investors will get more worried about stagflation. As expected, the committee did not change the target rate, but the Fed will slow the pace of balance sheet runoff. While not surprising since it was strongly hinted at in the January Fed meeting minutes, it does temporarily remove a risk to markets as it decreases the risk that Quantitative Tightening (QT) goes too far and disrupts short-term funding markets. So far, the Fed has unwound more than $2 trillion from its balance sheet, leaving about $6.8 trillion — well above pre-COVID-19 levels near $4 trillion. It was noted, however, that this move will likely be temporary, with the Fed reinstating QT after the debt ceiling discussions are over.

Stagflation?

Fed officials appear more downbeat about growth, paving the way for some downside risk in the dollar. From the latest projections, Fed staff expects growth to be 1.7% by the end of 2025, down from the December forecast of 2.1%. The unemployment forecast rose to 4.4% from 4.3%, and core inflation — on an annual basis — is expected to be 2.8%, up from 2.5% estimated in December.

New Fed Forecasts Hint of Stagflation

Source: LPL Research, Federal Reserve 03/24/25

Stagflation, a combination of low or no growth with persistent inflation, is not just a domestic risk. At the last meeting of Bank of England (BOE) officials, concerns across the pond are mounting about the same issues since trade wars benefit no one with impact across national boundary lines.

Investors were not surprised that the monetary policy-setting committee kept target rates unchanged. The committee is in the midst of policy fog as they await the repercussions from upcoming tariffs. And apparently, some companies have not waited until tariffs. According to the latest Beige Book, some firms have preemptively raised prices, creating some distortions with inflation data.

Despite this month’s inflation data having risks to the upside, we should expect core inflation to decelerate by the summer, in time for the Fed to cut in June.

The Hammer Award

Government jobs are often at risk when administrations get a fresh start. Perhaps most notable are the significant cuts to the federal workforce initiated by then-president Bill Clinton. The effort began after the National Performance Review initiative in March 1993. Over his eight-year term, Clinton reduced the federal workforce by approximately 380,000 jobs, which was about a 16% decrease. For those agencies able to improve efficiency and cut costs, Vice President Al Gore was gifted the symbolic “Hammer Award” in recognition of those efforts.

At that time, unemployment fell despite the cut in the federal workforce as the laid off workers were easily able to find new employment. Given the tight labor market currently, federal workers will not likely have any difficulty getting rehired, especially those with a professional degree. According to the Congressional Budget Office, total compensation for federal workers with a high school diploma, or less education, get 40% more than their private sector counterparts. Government workers without a college degree are getting a premium, while those with professional degrees are working at a discount.1 To be sure, some monthly job reports could be soft but are unlikely to create any serious ripple effects across the job market.

Leading Indicators May Not Be Leading

So, how are consumers taking these developments, and what should we pay attention to? The Conference Board’s metric has remained below pre-pandemic levels since December 2022. Is this index no longer a signal, but just noise? Feelings — a.k.a. “consumer expectations” — continue to drive this index lower and have been a net drag since mid-2021. Apparently, the vibecession continues. The better component is the credit index, which tracks swap spreads, bank lending conditions, and debt balances at margin accounts. Conditions have improved recently.

The steady decline in new orders is a clear signal of a slowdown, and that signal started emerging in early 2022. Although, orders for nondefense core capital goods show stability.

Without a doubt, the economy started showing signs of a slowdown a while ago, and this metric is helpful in reminding investors of the fragility of business conditions. The two main risks globally are trade uncertainty and stagflation. These risks are not just in the U.S. but also in international economies, especially in the U.K. as highlighted in the latest press release from the BOE. Global investors should brace for heightened volatility as the global economy adjusts to the new regime.

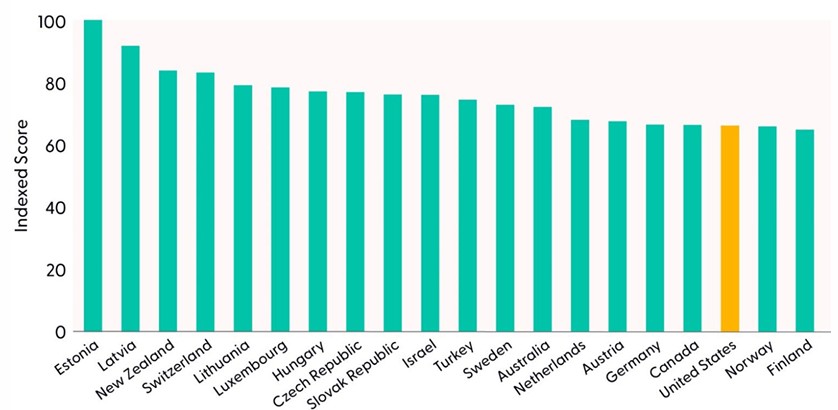

A Potential Tailwind from Tax Policy

As this “new regime” takes shape, the U.S. has the opportunity to take advantage of change. In today’s globalized economy, the structure of a country’s tax system plays a crucial role in determining its economic performance. International tax competitiveness, which refers to how favorable a country’s tax policies are compared to others, can significantly impact both business and investment decisions. In times of economic slowdown, the policy response — which often includes monetary easing — should include business-friendly tax policies. Here’s why investors should carefully monitor for any progress on the tax front that lifts the U.S. from its 18th rank in tax competitiveness — currently behind other developed countries like Germany and Canada.

U.S. Must Look for Ways to Improve Competitiveness

Source: LPL Research, Tax Foundation 03/24/25

International tax competitiveness is a key factor in boosting GDP. By attracting foreign and domestic investment, enhancing economic efficiency, promoting innovation and entrepreneurship, and reducing tax evasion, competitive tax policies can drive economic growth and improve a country’s overall economic performance. As countries continue to navigate the complexities of the global economy, maintaining a competitive tax system in the U.S. will be essential for fostering sustainable economic growth and prosperity. Investors should monitor Capitol Hill negotiations later this year as the Republican-led Congress seeks to preserve key provisions in the Tax Cuts and Jobs Act (TCJA), which are set to expire at the end of this year. These negotiations, if successful, could send a strong business and consumer-friendly signal that the U.S. is serious about remaining competitive on the global landscape.

Conclusion

The labor market is holding steady, which should provide a salve for investors worried about the cost of the “detox period” as Treasury Secretary Bessent highlighted in a recent interview. So far, the growth scare is not necessarily a recession scare, but uncertainty about trade and tax policy is weighing on investors. If inflation eases in the coming months, we should expect the Fed to cut rates by mid-summer, creating some relief for risk assets.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over emerging markets, growth over value, and large caps over small. However, we do not rule out the possibility of additional short-term weakness, as the pace of growth is cooling, and trade policy and geopolitical uncertainty remain high. While the risk-reward trade-off for beaten-down stocks has clearly improved, a swift and sustainable recovery seems unlikely under the cloud of trade uncertainty. We continue to monitor tariff news, economic data, earnings estimates, and various technical indicators to identify a potentially attractive entry point to add equities.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. In our view, the risk/reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities, investment-grade corporates) is more attractive than plus sectors. We believe adding duration isn’t attractive at current levels, and the STAAC remains neutral relative to our benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Mortgage-backed securities are subject to credit, default, prepayment, extension, market and interest rate risk. Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0003080-0225 Tracking # 713465 | # 713697 (Exp. 03/26)

Ask a Question

Ask a Question